Top 5 shipping industry stories of 2016

Recapping 2016

2016 has come and is already on the verge of going. For the ocean freight industry, it’s been one of the most turbulent years on record in terms of movement. In order to cope with the ever-evolving world economy, the industry has undergone numerous changes this year. As certain aspects expanded, others shrunk. Let us take a walk down memory lane and take a look at the top 5 shipping shake-ups of the year.

Top 5 shipping stories of 2016

5. Panama Canal expansion

On June 26, 2016, the Panama Canal inaugurated its newly expanded locks. The $5.4 billion expansion project allowed for the tripling in size of vessels that are able to access the waterway. In order to take advantage of the short shipping time provided by the canal, various liners have rerouted their services to the Panama. And already, in less than half a year, the canal has received 610 ships of varying sizes. That includes container-ships, LPG and LNG vessels, dry bulk carriers and vehicle vessels.

“We’re increasingly optimistic from what we’ve seen with these traffic patterns because they show that our customers are finding real value in the route not just in the time savings it offers; but in the efficient, reliable, and safe service we provide; and the growing port and transshipment options we’re making available to them.”

– Panama Canal Administrator Jorge L. Quijano

This proved a remarkable feat for the expanded canal, which had faced safety criticisms following a number of vessel crashes not long after its opening. And earlier this month, it welcomed its 500th neo-Panamax, the 8,200TEU Yang Ming Unity.

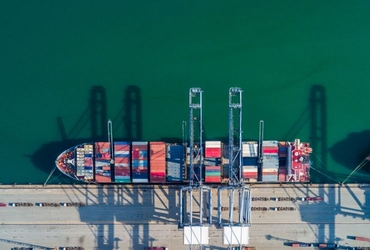

Here’s a video of an aerial view of a ship entering the new Panama Canal locks. [Credit: Panama Canal Authority]

4. IMO sets 0.5% sulfur cap

One small step for shipping, one giant leap for the industry. In late October, to the cheers of environmentalists worldwide, the International Maritime Organization announced a 0.5% sulfur cap on shipping emissions by 2020. That’s down from the current 3.5%, giving ship owners just over three years to cut their sulfur usage.

“The reductions in sulfur oxide emissions resulting from the lower global sulphur cap are expected to have a significant beneficial impact on the environment and on human health, particularly that of people living in port cities and coastal communities, beyond the existing emission control areas.”

– Kitack Lim, IMO Secretary-General

The IMO had, back in 2008, adopted this 0.5% sulfur cap that would come into effect in 2020. It then floated the idea to postpone this until 2025 due to a possible lack of low-sulfur fuel. But it wasn’t until a study confirming the availability of sufficient low-sulfur fuel by 2020 that the IMO set its implementation date of 2020.

While this may be good news, a recent study is warning that the cap may just result in an increase in CO2 emissions.

![]()

3. Announcement of Alliances reshuffling

Ocean Alliance, THE Alliance, 2M: These are three major shipping lines alliances that were announced and confirmed earlier this year. Come April 2017, these alliances will seek to take on each other amid a new battle of the rates. The groupings are as such:

2M Alliance : Maersk, MSC (with a slot purchase agreement with HMM)

Ocean Alliance: CMA CGM (with APL), China Shipping, OOCL, Evergreen

THE Alliance: K Line, Yang Ming, MOL, Hapag-Lloyd and UASC, NYK Line (this group contained Hanjin Shipping prior to its bankruptcy)

Such alliances have become increasingly important in the global shipping industry, as carriers seek to cut operational costs via partnerships. Members take advantage of each other’s resources and share ships, networks, and port calls. In practice, sharing vessels allows these shipping lines to operate without having to increase the number of ships. The advantage is that these partnered carriers can now offer a level of service they couldn’t before with only their own ships as a single shipping loop can tie up a vessel for weeks.

![]()

2. Mergers and acquisitions

This has been a year of unprecedented mergers and acquisitions for the shipping industry. From Hapag-Lloyd’s merger with UASC to Maersk’s acquisition of Hamburg Süd to Japan’s top three shipping conglomerates consolidating their shipping operations, shipping lines are clamoring to keep their necks above water. Amid a prolonged economic downturn and the persistent overcapacity, it will still be a while before the tides turn. Shipping consultancy group Drewry expects the industry to lose at least $5 billion this year. And in order to survive this gray period, carriers are turning to each other for help.

According to Drewry, a continuing trend of such mergers could result in a shortage of choices and higher rates in the long run. This is not music to the ears of any shipper. The shipping industry is continuously shrinking with these acquisitions and disappearing carriers. At the turn of the century, the top 5 ocean carriers controlled 35% of the world’s container fleet. That number has since inflated to 55%.

“This trend will continue as the leading five carriers have the largest order books and, as history has shown, the biggest appetite to acquire other carriers.”

– Drewry

The industry’s M&As in its current economic state is perhaps best summarized by NYK’s President:

"The purpose of becoming one this time is so none of us become zero."

-- Tadaaki Naito, President of NYK

![]()

1. Hanjin Shipping files for bankruptcy

Hanjin Shipping’s collapse is no doubt the news of the year. The historic downfall was described as the largest bankruptcy in the ocean freight industry. When it collapsed, Hanjin held a 2.9% market share and represented 8% of transpacific trade volume for the US market. It was the 7th-largest carrier in terms of TEU fleet. Today, less than four months on, it has fallen to 27th place, with a 0.3% market share.

The fall of such a significant player in the market sends shock waves across the industry, both short and long term. A day after it filed for court receivership, spot container freight rates on major routes from Asia skyrocketed a whopping 42%. Now in December, we’re still reeling from the effects. Empty containers continue to stack up in US West Coast ports, especially at the Port of Long Beach.

As the South Korean government dismantles Hanjin piece by piece, the industry has moved to cope. With Hanjin’s collapse, THE Alliance lost a member. The group has already devised a contingency plan, or what they call a “catastrophic instrument” to aid other members if and when necessary. Under this plan, alliance members can “facilitate the movement of cargo carried by the affected party”.

![]()

Top 5 shipping stories of 2017?

The industry is heading into the new year in a rather volatile and gloomy state. A year from now, which top 5 shipping stories will we be writing about? We don’t and can’t know for sure. **But here’s to hoping that the clouds will soon part, and may 2017’s top 5 shipping stories be more cheerful. **

We leave you now with a comment from our Vice President of Sales and Operations:

“Seeing a carrier of Hanjin’s size go bankrupt was an eye opener and hopefully, something the industry has learned from. The three alliances expected to come into effect next year suggests that it has. Whatever happens, 2017 will certainly continue to bring changes to our industry and it will be exciting to see what is coming next. “

– Klaus Lysdal, VP Sales & Operations, iContainers

From all of us at iContainers:

Happy New Year and may 2017 bring you much joy and success!

Related Articles