THE Alliance

THE Alliance: Who?

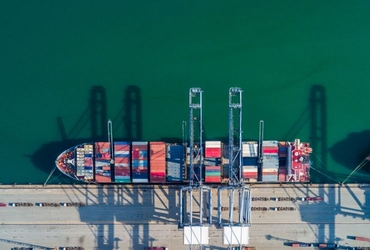

And then there were five. In April 2017, THE Alliance formed one of the three major shipping alliances setting sail following a musical chair reshuffle. Short for Transport High-Efficiency Alliance, it consists of Germany’s Hapag-Lloyd (with UASC), Japan’s MOL, K Line and NYK Line, and Taiwan’s Yang Ming Line. The ocean freight grouping was left one short following the collapse of South Korea’s Hanjin Shipping.

The alliance is set to last five years and includes a 240-vessel strong fleet. It will provide 32 services on all key east-west trades, including 13 transpacific routes and 6 Asia-Europe loops. Under the agreement, members can share vessels, charter and exchange spaces on each other’s ships. The group is also enhancing its Mediterranean to the US East Coast routes by partnering with Israel’s ZIM Line.

*Update: In Dec 2017, THE Alliance announced an expansion of its calls to come into effect in April 2018.

“The unique product will feature enhanced port coverage in Asia, North America, Europe including the Mediterranean as well as Middle East. The network of THE Alliance will ensure frequent sailings, high reliability and very attractive transit times for all shippers in the East-West trade lanes.”

- THE Alliance statement

Here’s a quick look at THE Alliance’s offerings.

![]()

The three major shipping alliances

THE Alliance falls short in terms of market share - its 16.5% against the 25.6% owned by the Ocean Alliance. But together, these two groupings are going head on against market leaders Maersk and MSC, who form the 2M Alliance with a 29.6% market share. South Korea’s HMM had been due to join, but will instead enter a 2M+H strategic cooperation with the duo.

Together, the three shipping alliances comprise of 12 shipping operators. They will be responsible for the majority of the container trade on the transpacific and Asia-Europe routes.

Riding out the rough times

Consolidation seems to be the way forward amid rough seas in the shipping industry. The world’s 20 biggest carriers are all expected to see losses for 2016. Overcapacity and a prolonged sluggish world trade have forced many carriers to come together.

“The few players left outside will either try to join in, shrink to become regional operators or go belly up.”

- Lars Jensen, Chief Executive, SeaIntelligence Consulting

M&A news formed one of the biggest shipping shake-ups of 2016, which saw an unprecedented amount of consolidations. That includes the merging of Japan’s top 3 liners’ container operations and that of China’s China Ocean Shipping Group and China Shipping Group. Let’s also not forget Maersk’s acquisition of Hamburg Süd.

Related Articles