The remains of Hanjin

Just a mere six months ago, Hanjin Shipping sailed the seas as South Korea’s largest ocean freight carrier and the world’s 7th biggest shipping container line. As you read this, a Korean court has declared the once-mighty carrier bankrupt.

In this post, we take an extensive look at how the shipping industry has feasted on Hanjin and what’s left of its carcass.

The collapse of Hanjin

Hanjin’s collapse marks the biggest bankruptcy to ever hit the container shipping market. It’s perhaps a cruel way to mark the empire’s 40-year-anniversary. Established as Hanjin Container Lines in 1977, it set itself out to be the country’s leading shipping line. But following a prolonged economic downturn in the market, Hanjin continued to see red after red. When its creditors refused to extend funds to service its $5.37 billion worth of debt last August, it had no choice but to file for court receivership.

“A creditor-led restructuring will end now. The company will have to find its own way to survive.”

– Official at Korea Development Bank, 30th August 2016

Since then, over the past few months, we’ve seen Hanjin Shipping being slowly and almost cruelly dismantled to the bones. Its vessels, employees, and routes set on the bidding table and offered to competitors. All this, in order to recuperate as much as it can to pay its creditors with the hopes of sailing into the open sea again. But as we now see, their original plan to re-emerge as an intra-Asia operator has failed.

With its more important services sold off, the company’s remaining assets will now be doled out to its creditors, who have until May 1st to file their right to claim debts.

The great Hanjin sale

By November, Hanjin had slipped from 7th to 21st place in Alphaliner’s top 100. Today, it’s disappeared completely, having shrunk to less than a tenth of its size. Following a drop in value and lack of sponsors, global accounting firm PWC recommended the full liquidation of Hanjin Shipping, in December – valued (at the time) at $1.57 billion. By early January, creditors claims had reached $26 billion, massively outweighing the value of Hanjin’s assets. Industry experts now warn that Hanjin bondholders could suffer losses of up to some $1.05 billion. Following PWC’s recommendation, Seoul’s Central District Court on Feb 2 set Hanjin’s liquidation announcement date for the Feb 17.

“Liquidating Hanjin is more economically viable than letting it continue business on a going concern basis.” – PricewaterhouseCoopers

In total, Hanjin’s vessels have netted some $460million in auction houses. Of the shipping lines, Maersk has emerged with the biggest hunger, chartering 11 vessels (77,000TEUs) from Hanjin’s fleet. That includes the two 13,000TEU units of Hanjin Africa and Hanjin Harmony.

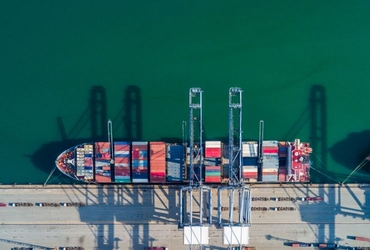

Hanjin’s once-600,000TEU-strong fleet has considerably diminished. After having returned all its chartered vessels and a mega sale, its number of slots now stands at under 45,000TEUs. Here’s a look at the December sales of Hanjin’s vessels [Image credit: Drewry Maritime Research]:

![]()

Rippling effect

It’s hard to imagine that just half a year ago, the South Korean line boasted 1,300 employees and an incredible fleet of 97 container ships and 44 bulk carriers. Today, its court receivership application continues to send ripples across the shipping industry.

The US freight industry is still trying to cope. With Hanjin accounting for nearly 8% of the transpacific trade, its collapse was felt most strongly at the ports of Los Angeles and Long Beach. Hanjin was one of the most active shipping lines at the Port of Long Beach. Following its downfall, the port recorded a 5.8% drop in cargo traffic year-on-year in 2016. Neighboring Los Angeles compensated with an 8.5% growth as many of Hanjin’s cargo hopped over to other shipping lines with agreements with LA.

“As the new year starts, we are grateful to be able to put the Hanjin bankruptcy behind us.”

– Duane Kanagy, Port of Long Beach Interim Chief Executive

To Hanjin’s credit, it persisted right to the end, believing that it could still, somehow, avoid liquidation. While there have been cases of bankruptcy annulments through appeals, this didn’t seem to be a viable salvage option for Hanjin. Nearly every single unit of the company has ceased its functions. Today, its website contains only a bulletin for creditors, perhaps a sign of it resigning to its fate.

Here’s an infographic timeline to offer a more comprehensive look at Hanjin’s dismantlement.

![]()

More sales of Hanjin’s vessels and operations will likely follow. At least, whatever is left. Already, Korea Line has won the bid for its lucrative transpacific operations. HMM will soon be taking over its Algeciras terminal in Spain and Tokyo and Kaohsiung terminals in Japan and Taiwan. Hanjin’s 54% Long Beach Terminal stake has also been offloaded to HMM and an MSC subsidiary. These are just the more prominent chunks of Hanjin.

Asia-US route to Korea Line

In a surprise outcome, Korea Line outbid compatriot HMM to win Hanjin’s core assets on its transpacific Asia-US route. With an 8% market share and annual sales of $3.4 billion, this is perhaps the largest and most coveted slice of the Hanjin pie. Together with its related workforce and seven overseas operations, it’s expected to fetch up to $85.4 million.

Five companies had participated in the preliminary bidding. But only HMM and Korean Line handed in final bids. Korean Line’s $31.5million win came as a surprise to many. Many had expected HMM to acquire these lucrative assets. The country’s #2 shipper had looked to bolster the South Korea-US shipping presence previously dominated by Hanjin.

“Korea Line had offered a more competitive bid price and better employment buyout terms than Hyundai Merchant Marine. We didn’t choose any backup bidder.” – Local Korean court official

This, however, rang well in Hanjin’s ears, who had hoped for this exact result. In its bid, Korea Line expressed its intention to allow 700 Hanjin workers to keep their jobs following the transfer. The line is also more financially stable than HMM, who themselves just managed to pull back from the brink of bankruptcy earlier in 2016.

Long Beach Terminal to MSC subsidiary

Meanwhile, MSC subsidiary, Terminal Investment Limited (TIL) has acquired Hanjin’s stake in US ports operator Total Terminals International (TTI). The acquisition involves all of Hanjin’s equity interests and shareholder loans and is in conjunction with HMM. Under the agreement, TIL will own an 80% stake and HMM the remaining 20%. The sale also includes TTI forgiving a $54.6 million debt owned by Hanjin.

“Our focus throughout the acquisition consultation has been, and will continue to be, rebuilding the business and servicing the needs of our affiliated shipping line MSC, its 2M partner Maersk, and our new joint venture partner HMM.” – Alistair Baillie, TIL President

Light at the end of the tunnel?

Many say Hanjin’s demise goes to show just how fragile and unpredictable the shipping industry is. Especially amid the current prolonged economic downturn. But perhaps, it’s also a sign of the battle of the fittest and a strength in numbers.

Over the past year, we’ve seen an unprecedented amount of shipping mergers and acquisitions. Japanese rivals NYK, MOL, and K-Line have teamed up in a bid to survive the downturn. China Ocean Shipping Group and China Shipping Group as well. Even an 80-year-long family-run shipping business has fallen – in the form of Maersk’s acquisition of Hamburg Süd.

The dramatic downfall of Hanjin was arguably, the biggest shipping shake-up of 2016, if not the decade. Its effects will send ripples across the industry for years to come. There’s no knowing what’s to come next in this tumultuous chapter. Just sit back, buckle, and hope for the waters to calm.

Related Articles