Ocean Freight News

Choose Category

Ocean Freight News

13 June 2025

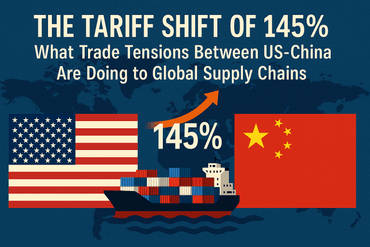

The 30% Tariff Shift: How US–China Trade Tensions Are Reshaping Global Supply Chains

Ocean Freight News

29 November 2023

Four experts weigh in on what's in store for the ocean freight industry in 2019

Previous Page

Next Page